Revolutionizing Population Health Risk Reduction: A Shift from Historical Costs to Root Causes

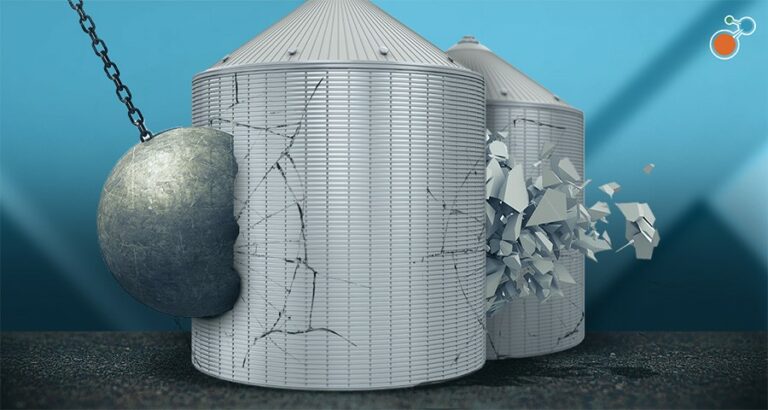

Written by Scott Conard, MD When it comes to population health risk reduction, the conversation is evolving. Historically, in the U.S., managing health costs has often been approached from an actuarial perspective—calculating insurance premiums based on past expenses and statistical projections. While this method has served its purpose, it focuses on trailing indicators like price per procedure and frequency of use, leaving the underlying drivers of healthcare costs largely unaddressed. But now, a shift is happening. We’re moving beyond simply accounting for costs to asking critical questions: What’s causing these costs to rise? What are the leading indicators that drive health risks and, ultimately, healthcare utilization? Moving Beyond Actuarial Science Traditional actuarial science calculates costs by factoring in variables like age, geographic location, medical diagnoses, and prescription usage. Insurers then project future costs based on past patterns, layering in adjustments for population demographics. While precise in its methodology, this approach is inherently backward-looking, focusing on how much was spent last year rather than proactively addressing what might reduce future spending. At its core, healthcare costs boil down to two key factors: price and use. But focusing solely on these metrics ignores a fundamental truth: the largest driver of healthcare cost is the risk of illness within a population. A high-risk population will inevitably lead to higher utilization and costs, while a low-risk population is significantly less expensive over time. As discussed HERE, we discuss how the real enemy in healthcare is disease, not just fighting costs Identifying and Addressing Health Risks To reduce health risks, we must first identify them. The answer lies in analyzing the population’s disease burden and the lifestyle factors driving it. Experience has shown that approximately 30% of a company’s population will eventually account for the majority of high-cost claims. More importantly, about 70% of those costly claims stem from conditions that could have been mitigated through early intervention and risk reduction. Lifestyle and Emotional Health: The First Line of DefenseMany of the conditions driving healthcare costs are preventable. Addressing lifestyle factors and emotional well-being plays a pivotal role in risk reduction. Strategies include: Navigating Healthcare Smarter The second pillar of health risk reduction involves empowering individuals to make smarter healthcare choices. This includes: High-Quality Care = Lower Costs A critical insight emerges when we focus on proactive health management: the highest-quality care is often the least expensive care. By identifying and addressing risks early, we not only improve health outcomes but also manage costs more effectively. Predictive analytics allow us to foresee who may require expensive treatments like surgery or dialysis, enabling timely interventions that are both effective and cost-efficient. The Future of Population Health This shift in focus—from trailing indicators like price and use to leading indicators like disease risk—represents a fundamental transformation in how we approach population health. By addressing the root causes of illness, promoting healthier lifestyles, and ensuring access to high-quality care, we can achieve significant reductions in healthcare costs while enhancing overall well-being. The path forward is clear: organizations must prioritize proactive health management strategies that address the underlying drivers of risk. By doing so, they can create healthier populations, reduce costs, and foster a more sustainable healthcare system. This isn’t just good for business—it’s essential for the future of healthcare. Dr. Scott Conard is a physician and healthcare strategist dedicated to improving organizational health outcomes through innovative approaches to employee wellness and healthcare management.